As Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The topic delves into the importance of comparing car insurance quotes across different countries, key factors to consider, and the process of obtaining and comparing quotes in the US, UK, and India.

Overview of Car Insurance Quotes Comparison

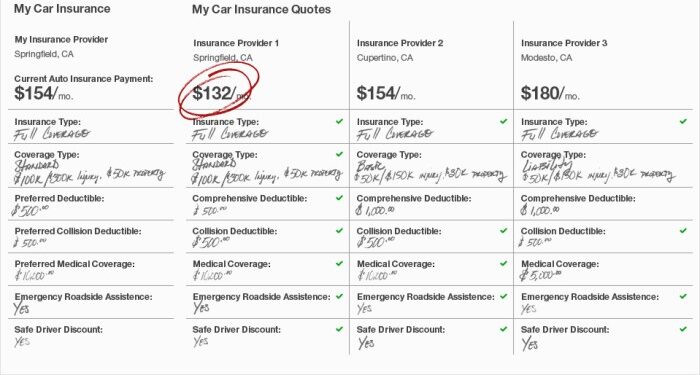

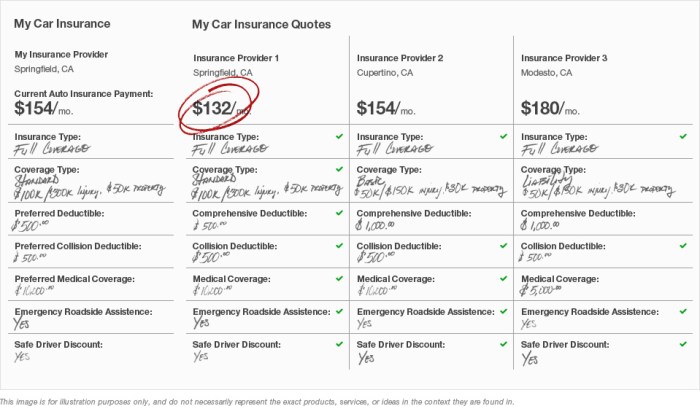

When it comes to car insurance, comparing quotes across different countries is essential to ensure you get the best coverage at the most competitive rates. Each country has its own set of regulations, coverage options, and pricing structures, making it crucial to evaluate your options carefully.

Key Factors to Consider

- Coverage Options: Different countries may offer varying levels of coverage, including liability, collision, comprehensive, and additional add-ons.

- Premiums: The cost of car insurance can vary significantly between countries, depending on factors such as driving history, age, and type of vehicle.

- Deductibles: Understanding the deductibles you will be responsible for in the event of a claim is important when comparing quotes.

- Exclusions: Be sure to review what is not covered by each policy to avoid surprises in case of an accident.

Process of Obtaining and Comparing Quotes

In the US, you can obtain car insurance quotes online through insurance company websites or comparison platforms. The UK also offers online tools for comparing quotes from different providers. In India, you can reach out to insurance brokers or visit insurers' websites to request quotes.

Car Insurance Market Trends in the US, UK, and India

In the ever-evolving world of car insurance, each country

- the US, UK, and India

- showcases unique market trends influenced by various factors such as regulatory frameworks, consumer behavior, and economic conditions.

Regulatory Impact on Availability and Pricing

- In the US, car insurance is mandatory in almost all states, leading to a highly competitive market with a wide range of coverage options and pricing variations.

- In the UK, the Financial Conduct Authority (FCA) regulates the insurance industry, ensuring fair practices and consumer protection. This oversight impacts the availability of insurance products and pricing strategies.

- In India, the Insurance Regulatory and Development Authority of India (IRDAI) governs the insurance sector, setting guidelines for insurers and impacting the availability and pricing of car insurance policies.

Popular Insurance Providers and Market Share

- United States:Major players like State Farm, GEICO, and Progressive dominate the market, each offering unique features and competitive pricing to attract customers.

- United Kingdom:Insurance giants like Aviva, Direct Line, and Admiral hold significant market share, providing a wide range of coverage options and tailored solutions for different customer segments.

- India:Companies like ICICI Lombard, New India Assurance, and Bajaj Allianz are prominent players in the Indian car insurance market, offering innovative products and services to cater to the diverse needs of consumers.

Coverage Options and Requirements

When it comes to car insurance, understanding the coverage options and requirements in different countries is crucial. Let's delve into the common types of coverage available in the US, UK, and India, as well as the minimum requirements mandated by law and optional add-ons offered by insurance providers.

Types of Coverage Options

In the US, car insurance typically includes liability coverage, which is divided into bodily injury liability and property damage liability. Collision and comprehensive coverage are also common options that provide protection for your vehicle in case of accidents, theft, or damage from other incidents.In the UK, car insurance often includes third-party liability coverage, which is a legal requirement.

This covers injuries to others and damage to their property. Additionally, comprehensive coverage is available for more extensive protection, including coverage for your own vehicle.In India, car insurance usually includes third-party liability coverage as mandated by law. This covers injuries to others and damage to their property.

Comprehensive coverage is also an option, providing broader protection for your vehicle against various risks.

Minimum Insurance Requirements by Law

In the US, each state has its own minimum car insurance requirements, but liability coverage is mandatory in almost all states. The minimum limits for liability coverage vary by state.In the UK, all drivers are legally required to have at least third-party liability insurance.

This ensures that you are covered for injuries to others and damage to their property in case of an accident.In India, third-party liability insurance is mandatory as per the Motor Vehicles Act. This coverage protects you against legal liabilities arising from injuries to others or damage to their property caused by your vehicle.

Optional Coverage Add-Ons

In the US, optional coverage add-ons can include uninsured/underinsured motorist coverage, personal injury protection, and roadside assistance. These additional coverages provide extra protection beyond the basic liability coverage.In the UK, optional add-ons may include breakdown cover, legal expenses cover, and courtesy car cover.

These add-ons offer additional benefits and peace of mind in various situations.In India, optional coverage add-ons can include zero depreciation cover, engine protection, and consumables cover. These add-ons enhance your comprehensive coverage by providing additional protection for your vehicle.

Premiums and Pricing Structure

When it comes to car insurance, premiums are a crucial factor that varies across countries based on several influencing factors. Let's take a closer look at how premiums and pricing structures differ in the US, UK, and India.

Factors Influencing Car Insurance Premiums

In the US, factors such as age, driving record, credit score, and the type of coverage can significantly impact car insurance premiums. Similarly, in the UK, insurance providers consider factors like age, driving experience, and the make and model of the vehicle.

In India, car insurance premiums are influenced by factors such as the age of the vehicle, geographical location, and the insured declared value (IDV).

Average Cost of Car Insurance Premiums

On average, car insurance premiums in the US tend to be higher compared to the UK and India. According to recent data, the average annual car insurance premium in the US is around $1,500, while in the UK, it ranges between £500 to £700.

In India, car insurance premiums can vary based on factors like the type of coverage chosen and the age of the vehicle.

Pricing Structures Based on Driver Profiles, Vehicle Types, and Geographical Locations

The pricing structure for car insurance can differ based on driver profiles, vehicle types, and geographical locations in each country. For instance, in the US, younger drivers with less experience may face higher premiums, while luxury vehicles can also lead to increased costs.

In the UK, urban areas with higher rates of accidents may have higher premiums. In India, the geographical location plays a significant role, with premiums varying between urban and rural areas.

Claims Process and Customer Service

When it comes to the claims process, insurance companies in the US, UK, and India follow specific procedures to ensure that customers are taken care of in case of an accident or damage to their vehicle. Let's compare the efficiency and customer service quality of insurance providers in handling claims in each country.

Claims Process in the US

In the US, insurance companies typically require you to report the claim as soon as possible after an incident. The process involves filing a claim, providing documentation, and working with adjusters to assess the damage and determine coverage.

Claims Process in the UK

In the UK, insurers also require prompt notification of a claim. The process may involve submitting evidence such as police reports or witness statements. Insurers aim to settle claims fairly and efficiently.

Claims Process in India

In India, the claims process may vary slightly depending on the insurance company. However, it generally involves notifying the insurer, providing necessary documents, and getting the vehicle inspected for damage assessment.

Efficiency and Customer Service Comparison

- US: Customer service in the US is known for being responsive and efficient in handling claims, with many insurers offering digital tools for easy claim processing.

- UK: Insurance providers in the UK are recognized for their quick response to claims and transparent communication with customers throughout the process.

- India: Customer service in India is improving, with insurers focusing on streamlining the claims process and enhancing customer experience.

Customer Satisfaction Ratings and Reviews

Customer satisfaction ratings and reviews play a crucial role in evaluating insurance companies. While individual experiences may vary, it is essential to consider feedback from customers to gauge the overall quality of service provided by insurers in each country.

Final Conclusion

In conclusion, this discussion on Shop Car Insurance Quotes: Multi-Country Comparison (US, UK, India) offers valuable insights into various aspects of car insurance across different countries, providing a comprehensive understanding for readers navigating the complexities of the insurance market.

Commonly Asked Questions

What factors should I consider when comparing car insurance quotes?

When comparing quotes, consider coverage options, premiums, deductibles, and exclusions to make an informed decision.

What are the common types of coverage options available in the US, UK, and India?

Common coverage options include liability, collision, comprehensive, and uninsured/underinsured motorist coverage across these countries.

How do pricing structures differ based on driver profiles, vehicle types, and geographical locations?

Pricing structures vary based on factors like age, driving history, type of vehicle, and location, influencing the cost of premiums.